KlimaDAO Impact Report: Analysis of the Base Carbon Tonne

- KlimaDAO

- Sep 6, 2022

- 14 min read

Executive summary

Tokenized carbon pools are a foundational innovation at the heart of the on-chain Voluntary Carbon Market (VCM). The ability of market participants to transact easily, with price certainty, and with complete information are essential characteristics required to scale the VCM. By grouping together carbon projects that share similar vintages and methodologies, carbon pools make it possible to establish a functioning, liquid, and transparent market for carbon credits.

Launched in October 2021 on the Polygon network, and in collaboration between Toucan Protocol and KlimaDAO, the Base Carbon Tonne (BCT) was one of the first on-chain carbon pools, preceded by only Moss’s MCO2. To date, nearly 22 million carbon credits have been bridged over to Polygon. By design, BCT represents the widest criteria carbon token, accepting all Verra-approved methodologies for credits issued from 2008 onwards.

Over the last few months, a number of key events have shaped the discussion around BCT, and some have raised concerns around the quality of the underlying projects in the pool. These events include the selective retirement of credits in association with the launch of Toucan’s Nature Carbon Tonne (NCT) pool, and more recently the discussions around the ~600K HFC-23 tokens in the BCT pool. In this report, we seek to respond to these concerns by sharing insights from AlliedOffsets, a leading data and analytics consultancy active in the VCM.

We found that over 9 million credits in the BCT pool have identical credits from the same project, trading at over $5.00 in the traditional market, and the equivalent market cap of the BCT pool off-chain is calculated to be roughly $87 million. This gives BCT a roughly 62% lower valuation than its off-chain counterparts.

Key takeaways

BCT is a live pool of tokenized carbon credits that can be retired for environmental benefit via the KlimaDAO Retirement aggregator.

Over 9 million carbon credits that are found within the BCT pool have been trading for over $5.00 off-chain, which is more than three times the current on-chain price despite them being the same credits.

In addition to the 19.6 million carbon credits that have been bridged for inclusion within BCT, the 151 carbon projects represented in the pool have provided 90.9 million carbon credits for environmental benefit claims for off-chain entities and individuals.

Corporate organizations such as Delta Airlines, Telstra, and Brisbane City Council have used the carbon projects contained within the pool, according to the Verra Registry.

The majority of credits held within the BCT pool are renewable energy credits with a vintage of 2008 to 2015.

The data presented is in tension with the CarbonPlan article that describes the types of carbon credit contained within BCT as ‘excluded’ from the market.

BCT’s role in the on-chain VCM is to service the area of the market that may require lower-cost, mitigation-type carbon credits. Other pools such as NCT, NBO, and UBO have stricter vintage and methodology requirements, leading to them having ‘higher quality’ credits within them.

Introduction

By using public blockchains and DeFi-enabled infrastructure that facilitates the carbon market, KlimaDAO is increasing data availability, reducing margins, and bringing unprecedented transparency to the space. This transparency has led to significant discussion around the perceived quality of tokenized carbon within the KlimaDAO ecosystem.

However, it can be challenging to compare and contrast the state of on-chain carbon with private, off-chain carbon market solutions because of the opacity of the latter. For example, of the roughly 512 million carbon credits retired on the Verra carbon registry since its launch in 2005, 294 million tonnes have been retired with blank beneficiary details, making it challenging to assess who has retired these credits and for what reason.

To this end, KlimaDAO has commissioned analysis of Toucan Protocol’s BCT by AlliedOffsets, a data and analytics consultancy active in the VCM. The BCT pool was designed by Toucan Protocol with input from KlimaDAO and other advisors, to support the launch of KlimaDAO in October 2021. The results of this work are presented in this article.

The analysis does not consider the state of other tokenized carbon pools, such as specific nature-based pools including Toucan’s Nature Carbon Tonne (NCT), C3’s NBO, or Moss's MCO2, or C3’s renewable-focussed pool UBO. All of these other pools have stricter gating criteria than the BCT pool. To learn more about the composition of these pools and the state of the tokenized carbon ecosystem, see KlimaDAO’s carbon dashboard.

In addition, this analysis only considers the state of BCT as at August 2022, and it does not consider the historical composition of the BCT pool. Note that KlimaDAO initially seeded the BCT pool with over 500,000 VCS carbon credits from nature-based solutions with a vintage of 2014 or later. The reason that these credits are no longer contained within the BCT pool is because of Toucan Protocol’s decision to commission liquidity providers to selectively redeem the nature-based projects with a vintage of 2014 in a “mass rebalancing event” in association with the launch of their NCT pool.

In addition, please note that the KlimaDAO Forum is also hosting a discussion on taking action to redeem and burn the HFC-23 credits from the BCT pool. There are approximately 672,000 credits within this pool; assuming they are burnt this will reduce the supply of BCT by only 3.5%, and leave 1.03% of the pool (or 188,000 carbon tonnes) to be composed of credits from the chemical and industrial sectors.

Overview of the BCT pool

The BCT pool represents an index of tokenized carbon credits that can be used by the KlimaDAO retirement aggregator to retire carbon credits as part of a carbon neutral strategy. KlimaDAO holds the majority of liquidity for this pool on the SushiSwap decentralized exchange, where it is paired with $KLIMA.

During the Toucan tokenization (a.k.a. bridging) process, the environmental benefit of these tokenized carbon credits is not claimed – to do this, they must be retired on the blockchain, which permanently removes from the market (via a token ‘burning’ mechanism) the underlying tokens corresponding to the original Verra credits. Using KlimaDAO’s retirement aggregator, users can either indiscriminately retire the oldest vintage project in the BCT pool, or they can handpick projects in the pool to hold and retire projects that best fit their objectives (note that selective redemption incurs a 25% fee imposed by Toucan Protocol).

The initial gating criteria for BCT was any Verified Carbon Standard (VCS) registered carbon project with a vintage of 2008 or newer. On May 12th, 2022 the gating criteria was updated to include any VCS carbon project with a vintage of 2008 and a vintage delta (i.e. the difference between issuance date and vintage date) of no more than 10 years. Hence, the BCT pool is the broadest, most inclusive carbon pool on the Polygon blockchain; by comparison, the MCO2, NCT, and NBO pools are limited to nature-based projects with more recent vintages, while the UBO pool – the most comparable pool to BCT – only accepts carbon credits from 2014 onwards.

By design, BCT primarily services the lower-cost segment of the market.

BCT pool pricing

BCT currently has a supply of 19,331,931 carbon credits from 151 unique carbon projects issued by the Verra Registry (with 309 project-vintage combinations). The SushiSwap Liquidity Pools (KLIMA/BCT and USDC/BCT) that facilitate the exchange of these tokens has over $11 million in liquidity. The BCT token has had a market price of between $1.45 and $3.00 over the past two quarters. The market cap of the BCT pool has therefore been between $30 million and $43 million over the past two quarters.

Data provided by AlliedOffsets demonstrates that around 9 million of the carbon credits that are represented in the BCT pool and are also being traded within the legacy market via broker deals are trading at an estimated price of $5.00 or more. The average off-chain price for all the carbon credits contained within the BCT pool is estimated to be around $4.50.

This reveals that sourcing and retiring carbon credits off the blockchain through carbon credit retailers or via broker deals is currently significantly more expensive than doing so on-chain.

Note that because individual projects contained within the BCT pool can be ‘selectively redeemed’ and retired through the KlimaDAO retirement aggregator, the price discrepancy may be larger than these general averages. For example, there are a number of carbon projects that have credits within the BCT pool and are being traded within the legacy market that are currently estimated to have a price discrepancy of over $8.00 (e.g. those projects contained in the pool with a vintage of 2020).

The table below indicates the estimated price discrepancy between on-chain and off-chain carbon credits, using five example projects.

Off-chain utilization of BCT

In our previous article diving into the role of carbon mitigation and removal credits, we discussed how the most common types of carbon credit that are issued by the Verra Registry and retired by carbon credit offsetters are mitigation-type credits, and in particular renewable energy credits with older (e.g. pre-2015) vintages. This is the typical type of carbon credit found within BCT.

There are 151 discrete carbon projects that have carbon credits represented in the BCT pool. These 151 carbon projects have to date provided 90.9 million carbon credits for environmental benefit claims for off-chain entities and individuals. Of these, roughly 44.3 million have been retired by a variety of corporations, individuals, and small- and medium-sized enterprises (SMEs). 46.6 million have been retired with ‘no data’, meaning it is not possible to say who the credits were retired on behalf of, or for what reason. 19.9 million carbon credits from these 151 discrete projects have been bridged on to the blockchain and deposited into the BCT pool, making it the single biggest point of identifiable demand for the VCM in the past year.

Of the 44.3 million carbon credits from the 151 supported projects within BCT that have been retired off-chain with information on who the credits have been retired for, it can be seen that a diverse set of organizations are using these carbon credits to service their climate strategies. They include large multinational transportation and energy organizations, the public sector, telecommunications companies, and service sector companies, as well as a large number of individuals and SMEs.

Delta Airlines is one of the world’s largest buyers and retirees of carbon credits (offsetting roughly 1 million credits in 2020), and many of the carbon credits contained within BCT demonstrably fit their requirements to deliver on carbon neutrality.

Carbon credit types within BCT

BCT consists primarily of mitigation-type carbon credits, with 17,804,754 (or 92%) of the pool being from renewable energy projects. This means that BCT holds an equivalence of 6.9% of the historical retirements of renewable energy projects from the Verra Registry.

Of all the nature-based tonnes that were held in the pool, 169,908 nature-based projects remain. All of these credits have a vintage of pre-2014 (i.e. they are nature-based tokenized carbon credits that are ineligible for Toucan’s NCT pool). The nature-based credits that were previously in the pool were removed by Toucan Protocol for the launch of their NCT pool.

There are 297,573 credits in the pool from waste disposal projects; they make up roughly 1.6% of the BCT pool. This means that BCT holds an equivalence of 2% of the historical retirements of waste disposal projects from the Verra Registry. In addition, there are 859,698 credits from chemical/industrial projects, which means that BCT holds an equivalence of 3.1% of Verra retirements of this technology type. However, the proposed burning of the HFC-23 credits in the pool by the KlimaDAO treasury will reduce this number by 672,249.

Carbon credit vintages within the BCT pool

The BCT pool covers a wide range of vintages, spanning from the gating criteria vintage date of 2008 up to 2020 vintages. Roughly 50% of the credits in the BCT pool have a vintage of 2013 and later, and 25% of the credits in the pool have a vintage of 2015 and later. This provides a relatively broad spread of vintages for potential offsetting.

In terms of how this shapes up against historical market activity, tokens bridged to BCT represent between 5% and 10% of historical Verra retirements for vintages 2008, 2011, and 2015; between 2.5% and 5% of historical Verra retirements for vintages 2009, 2010, 2012, 2013, 2014 and 2017; and between 0.5% and 2.5% for vintages 2016, 2019, and 2020.

This affirms BCT’s role in the market, in that it primarily provides carbon credits for higher volume carbon credit retirements using carbon mitigation projects that may typically be attainable for lower costs – such as those used to fulfill carbon neutral strategies for large emitters with significant historical carbon footprints.

By comparison, carbon pools like NBO, NCT, and MCO2 aim to serve the needs of more discerning buyers who prefer higher-quality projects with more recent vintages.

Geography

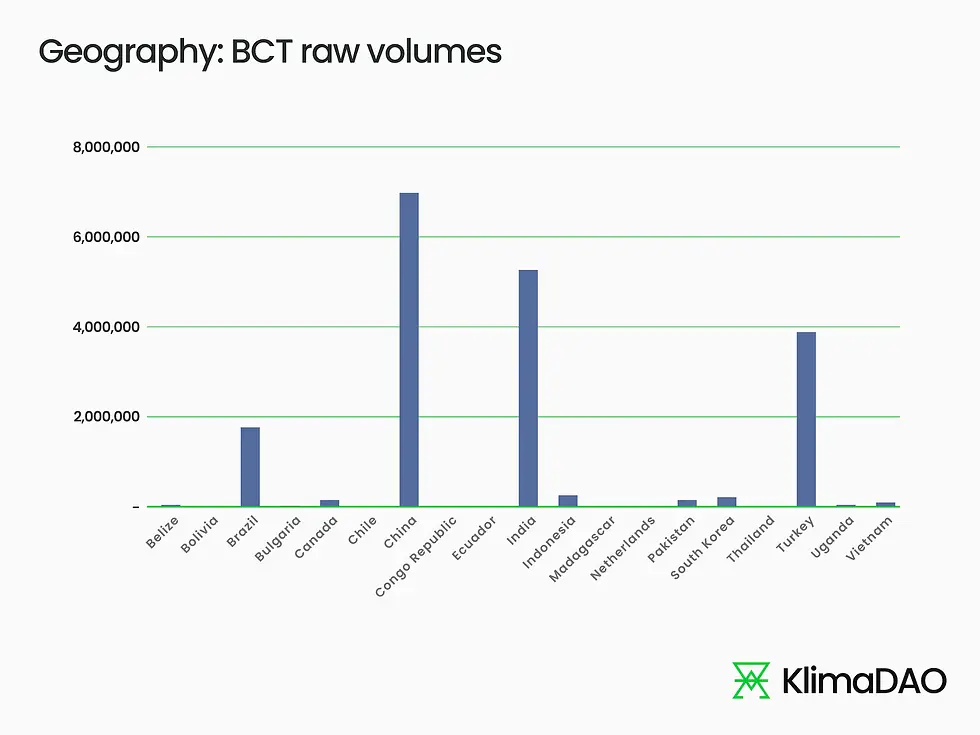

BCT contains a disproportionate amount of carbon credits from projects in Bolivia, Democratic Republic of Congo, Pakistan, Turkey, and Vietnam compared with typical carbon credit retirements for the off-chain market. In general, the type of carbon credits contained within the BCT pool has a fair spread across developing nations within South East Asia, South America, and Africa.

The below graphic indicates the relative amount of carbon credits that the BCT pool holds per country, in comparison with the total amount of retirements made in the Verra Registry.

In terms of raw volume, BCT primarily contains credits from China, India, and Turkey, three countries who have historically issued significant volumes of carbon credits and thus make up a large share of the VCM.

BCT as an incentive to bridge

The deployment of the BCT pool and the launch of KlimaDAO’s bonding and staking mechanisms in October 2021 created unique incentives that enabled the building of liquidity for tokenized carbon on the public Polygon blockchain. This has enabled a number of oft-cited demand-side issues of the VCM – such as opacity, fragmented liquidity, and poor accessibility – to be addressed directly through KlimaDAO’s platform.

Above, we have explored how the same carbon credits contained within the BCT pool are also being used to service a range of traditional credit consumers, indicating that the type of credits within BCT are suitable for corporate and retailer offsetters alike. Through analysis of the data, we can also understand how the holders of carbon credits reacted to these novel incentives, and consider how this can help play a role in scaling the VCM in the future.

41 projects of the 151 projects bridged onto the blockchain have had all of their supply bridged onto the blockchain (i.e. no retirements have been made for carbon offsets in the market, and all supply has been bridged). These 41 projects represent roughly 16% of the supply of the BCT pool.

The majority (74%) of this subsection of the BCT pool have a vintage of 2014 or later, and are renewable energy projects.

Extending the above criteria to include projects that have had 95% of all their supply bridged (and 5% of their supply used for off-chain carbon retirements) shows that 51% of the pool fits that criterion. 40% of those are from 2014 or later, with the majority of these credits again coming from renewable energy.

Hence, of the carbon projects that have used all or the majority of their supply for the purpose of depositing into the BCT pool, they represent an in-demand segment of the VCM – namely renewable energy carbon projects with a broad spread of vintages.

The incentive mechanisms introduced by KlimaDAO are less than one year old, but have demonstrated their ability to facilitate the migration of the VCM on to the blockchain, and in turn drive up the liquidity, transparency, and accessibility of the VCM. Moving forward, there is a vision that carbon project developers can immediately find demand for their carbon credits by leveraging this DeFi-enabled infrastructure. Delivering on this vision will enable greater market access at the supply side of the market – and, on balance, allow the market to work better for the organizations and communities who are developing carbon projects. By using KlimaDAO’s Klima Infinity tooling, these tokenized carbon credits can quickly and transparently be retired on the blockchain for environmental claims from individuals and organizations alike.

Although there is evidence that KlimaDAO and the BCT pool have enabled project proponents to directly engage with the on-chain VCM, establishing $KLIMA as a clear, stable signal to the market is a long-term project. Over time, the treasury must facilitate the diversification of the types of carbon credits on the blockchain to ensure the availability of credits to fulfill a variety of needs across retail, corporate, and Web3 demand.

A word on “Zombie Credits”

Prior to discussing the concept of “Zombie Credits” popularized by CarbonPlan, we should reaffirm that BCT is a highly liquid carbon reference pool where the carbon credits found within have not yet had their environmental benefit claimed through an on-chain retirement. Additionally, BCT is not the only carbon reference pool on the blockchain, as it sits alongside the NCT, NBO, UBO, and MCO2 carbon pools.

The CarbonPlan article titled “Zombies on the Blockchain” suggests that the majority of the carbon credits within the BCT pool are ‘excluded’ from ‘large segments’ of the market. It defines this ‘exclusion’ from the market by comparing BCT – a pool primarily composed of carbon credits used for corporate and individual offsetting purposes – with some of the strictest Core Carbon Reference contracts such as CORSIA’s initiative for the international aviation industry. As the CORSIA requirements are specific to the aviation industry, rather than a general-purpose group of credits for corporate carbon offsets, the comparison does not appear to be sincere.

In addition, the article fails to mention the key criteria that projects from ICROA-endorsed carbon standards such as Verra are required to deliver against to issue a carbon credit. Clearly, Verra-issued carbon credits are not ‘excluded’ from the market as businesses and consumers are free to purchase and retire these credits – and they do. These ICROA-endorsed standards are typically the most transacted, and most trusted, in the market due to the decades of work done by leading organizations like Gold Standard and Verra to establish rigorous methodologies around the issuance of carbon credits.

Carbon credit transactions and retirements indeed happen for carbon credits of ‘higher’ and ‘lower’ quality than the BCT pool; the BCT pool simply represents one subsection of the market – which is primarily renewable energy credits with a vintage of 2008 onwards, and a vintage/issuance delta of no more than 10 years.

Another tenet of the CarbonPlan article is that the credits must be illegitimate if they have not been transacted for a period of two years prior to being bridged. However, the article does not present any analysis of the outstanding 450 million carbon credits that are currently on the Verra Registry to indicate how much churn there is in the market. Given that the VCM only surpassed $1 billion in traded volume in 2021 for the entire market – a market acknowledged as highly illiquid – it is not surprising to see that when our ecosystem launched with rewards for participants to build liquidity on the blockchain, it had the desired effect of driving transaction volume on credits that had otherwise not experienced demand for an extended period of time.

Conclusion

Importantly, what is clear from the AlliedOffsets report is that the exact same projects comprising the BCT pool are being traded off-chain by VCM stakeholders and utilized for climate goals by demand-side participants around the world.

As overall carbon liquidity grows on-chain and interoperability between carbon pools is standardized, we will likely see additional carbon pools come online that expand the choice that demand-side participants have for various offset groups – for example C3’s ARBOL pool. Inter-pool arbitrage will assist in price discovery based on the demand that different offset project types have, and clear pricing signals between carbon pools will help provide a baseline market price expectation for project developers to reference. These are important developments in creating a more efficient carbon market and an endeavor that KlimaDAO is proud to be spearheading.

It is challenging to identify the motivations and activities of participants in a highly opaque market that predominantly trades over the counter, with market insights typically shared only in retrospective survey-based reports. Analyses released between 2019 and 2021 about the VCM indicated it was moving toward a heady phase of growth: McKinsey predicted 15x growth by 2030 and 100x by 2050, while the Taskforce on Scaling the Voluntary Carbon Market suggested such growth was required by the market to meet mid-century carbon targets.

It would appear that one of the key things achieved by KlimaDAO and the BCT pool was greater exposure and transparency for the VCM – while also fulfilling the need for greater liquidity and volume, to scale up this important market. This article was updated on Sep 26th 2022 with the following changes 1. The number of projects in the BCT pool was changed from 309 to 151. There are 151 unique projects with 309 project-vintage combinations in the BCT pool. 2. The number of projects with 100% of supply bridged on to the blockchain was changed from 147 to 41. 3. The total number of carbon credits from projects with 100% of supply bridged was changed from 40% to 16%.

Disclaimer: The information provided in this blog post pertaining to KlimaDAO (“KlimaDAO”), its crypto-assets, business assets, strategy, and operations, is for general informational purposes only and is not a formal offer to sell or a solicitation of an offer to buy any securities, options, futures, or other derivatives related to securities in any jurisdiction and its content is not prescribed by securities laws. Information contained in this blog post should not be relied upon as advice to buy or sell or hold such securities or as an offer to sell such securities. This blog post does not take into account nor does it provide any tax, legal or investment advice or opinion regarding the specific investment objectives or financial situation of any person. KlimaDAO and its agents, advisors, directors, officers, employees and shareholders make no representation or warranties, expressed or implied, as to the accuracy of such information and KlimaDAO expressly disclaims any and all liability that may be based on such information or errors or omissions thereof. KlimaDAO reserves the right to amend or replace the information contained herein, in part or entirely, at any time, and undertakes no obligation to provide the recipient with access to the amended information or to notify the recipient thereof. The information contained in this blog post supersedes any prior blog post or conversation concerning the same, similar or related information. Any information, representations or statements not contained herein shall not be relied upon for any purpose. Neither KlimaDAO nor any of its representatives shall have any liability whatsoever, under contract, tort, trust or otherwise, to you or any person resulting from the use of the information in this blog post by you or any of your representatives or for omissions from the information in this blog post. Additionally, KlimaDAO undertakes no obligation to comment on the expectations of, or statements made by, third parties in respect of the matters discussed in this blog post.